Picture this: you’re sitting on a pretty penny – in the form of a Toronto condo, and you’re wondering, “Should I cash in on the market highs, or should I sit tight, nurturing this investment for long-term returns?” This isn’t just a passing thought; it’s a pivotal decision that could have a significant impact on your financial future.

Let’s break it down.

Hold on for a moment! Have you subscribed to our channel? Click here. Stay in the loop with our newest posts and never miss out on exciting updates!

To Rent or To Sell? That’s the Golden Question

The Toronto real estate market is a fascinating mix of dynamic forces. With the Bank of Canada’s overnight lending rate at 5%, and Toronto rents soaring with a 15.4% increase since last year, the decision between selling or renting out your condo isn’t a cut-and-dried affair. It’s like balancing on a tightrope, with high stakes on each side.

Here, we’ll lay out the key considerations to help you make an informed decision.

Playing Landlord: The Perks and Pains

If you’re considering renting out your condo, you’re eyeing the landlord game. It comes with its share of advantages and challenges:

- The Perks:

1. Regular Income Stream: Renting out your condo could mean a consistent flow of income every month. Who wouldn’t appreciate that extra cash padding their bank account?

2. Potential for Long-term Growth: By holding on to your condo, you are betting on its potential to appreciate over time. In other words, you’re nurturing a seed that could grow into a massive wealth tree down the line.

- The Pains:

1. Juggling Responsibilities: Being a landlord isn’t always a walk in the park. It involves managing property maintenance, maintaining good tenant relationships, and navigating the legal landscape of rental laws.

2. Hidden and Not-So-Hidden Costs: The journey to profitable renting isn’t straightforward. It involves condo fees, property taxes, repair bills, and more. Plus, with a possible mortgage rate hike, when your current rate runs out, the financial equation could change.

Cashing in Now: The Highs and Lows

Alternatively, you could be thinking about cashing in, selling the condo while the market’s hot. Here’s what you need to weigh up:

- The Highs:

1. Immediate Access to Equity: Selling your condo now would be like hitting the jackpot, unlocking your equity instantly. You could use these funds to invest further or to buy a home you’ve been dreaming of.

2. Freedom from Landlord Hassles: Selling means trading property maintenance issues, tenant woes, and legal puzzles for a peaceful, landlord-free life.

3. Riding the Market Wave: With condo values on the upswing, selling now could feel like catching the perfect wave, bringing you substantial financial gains.

4. Capital Gains Tax Exemption: If your condo has been your primary residence, you get to dodge the capital gains tax bullet, sweetening the deal further.

Interested in learning more about selling your home or condo? Gain valuable insights from our collection of informative blogs on the subject:

- Pricing Secrets You Should Know Before Selling Your Toronto Condo

- Master the Art of Negotiation: Sell Your Home like a Pro and Make Bank!

- Selling Your Home? Don’t Hit the Pause Button on Your Next Purchase – Here’s Why

- The Lows:

1. No More Regular Income: Selling your condo would mean bidding goodbye to potential rental income in the future.

2. FOMO on Future Appreciation: If you cash in now, you might miss out on potential future appreciation of your condo’s value.

3. Re-entering the Market Could Be Tough: With prices on an upward trend, getting back into the market later might pose challenges, particularly with mortgage qualification and fluctuating interest rates.

The Number Crunch: Scenarios to Ponder Over

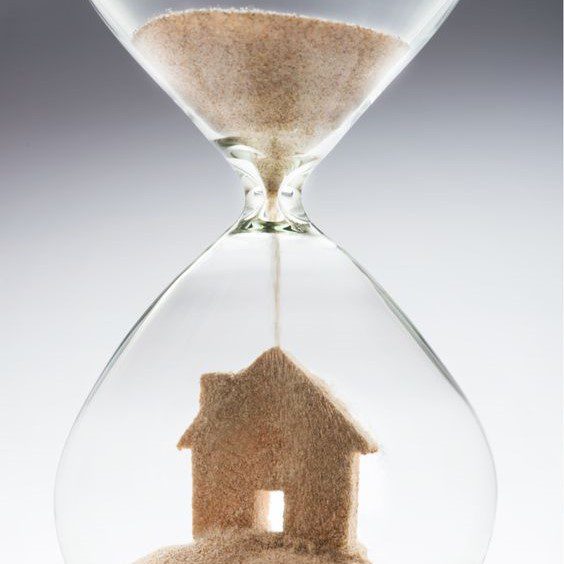

Ready for some number-crunching? Let’s consider three hypothetical scenarios, assuming a $750,000 selling price for the condo, $250,000 equity at stake, a fixed mortgage interest rate of 1.79% until 2025, and a HELOC rate of 4.99% for the next four years:

Scenario 1: The Landlord Game

Renting out your condo at a potential $2,500 monthly rate, could yield an annual income of $30,000. After accounting for mortgage, condo fees, and taxes, you’re still looking at a decent profit. Keep in mind though, the mortgage rate rise in 2025 could alter this scenario.

Scenario 2: The HELOC Route

If you’re considering buying a new property, a HELOC could be your way to unlock equity. Remember, borrowing isn’t free. A 4.99% interest rate on a $250,000 loan translates to $12,475 in annual interest. If the net income from rental (after expenses) and annual appreciation outweigh the HELOC cost, you’re on to a winning strategy.

Scenario 3: The Selling Move

If you opt to sell the condo, you’d walk away with a $250,000 equity pot, ripe for reinvestment or buying a new property. Plus, you get to play dodgeball with capital gains tax, making this a tempting choice.

Gazing into the Future: The Long-term View

If we look at history, real estate across Canada appreciates between 4-7% per year. That means your $750,000 condo could potentially be worth between $975,000 and $1.15 million in just five years.

On the other hand, selling now could let you cash in and invest in something potentially more lucrative, or it could fund a lifestyle upgrade. But here’s the tricky part: the real estate market is unpredictable. Nobody knows what could happen over the next five years. You need to assess your personal goals, financial situation, and risk tolerance before making a decision.

Final Thoughts

Weighing the sell or rent dilemma involves careful consideration of personal goals, financial health, and market dynamics. While selling promises immediate equity and freedom from landlord hassles, renting could yield long-term financial gains. Remember, there’s no right or wrong answer, just what makes the most sense for you. An experienced real estate professional can guide you through this process, helping you arrive at the most rewarding decision.

Ready to dive deeper into this equation? Give me a call at 647-973-8392. Let’s crunch the numbers and navigate this journey together!